Accounting & Tax for Private Business Owners

Expert accounting and tax solutions for Private Business Owners—designed to help you take control, reduce risk, and grow your financial universe with confidence.

/Images/Industries/Automotive-Repairers-Mobile.webp?width=1120&height=1088&name=Automotive-Repairers-Mobile.webp)

Accounting & Tax Solutions

Most accountants tick boxes. We solve problems before they happen.

At Kelly+Partners, you get more than compliance—you get a proactive financial partner who helps you reduce tax, protect assets, and grow your business with confidence.

Our Chartered Accountants provide year-round support, with structured systems and expert advice tailored to your personal, business, and family needs.

Accounting & Tax Services

Business Accounting

Strategic business accounting and tax advice to help business owners take control of their financial universe and maximise the rewards of their hard work.

McDonald's Accounting

With over 35 years advising McDonald’s® franchisees, we provide the structure, reporting, and tax strategy to help Owner-Operators grow, protect assets, and stay in control.

Cryptocurrency Accounting

Crypto tax clarity, delivered. We stay ahead of changing laws and reporting rules to help you stay compliant, minimise tax, and protect your digital assets.

Specialist Tax & Legal Consulting

Kelly+Partners Tax Legal is a New South Wales–registered specialist taxation law firm, and the only boutique firm that offers the full spectrum of direct, indirect, and international tax services.

Bookkeeping & Payroll

Structured, accurate, and audit-ready. We manage the numbers behind the scenes, so you stay focused on growth—with full visibility and zero surprises.

Business Growth Tools

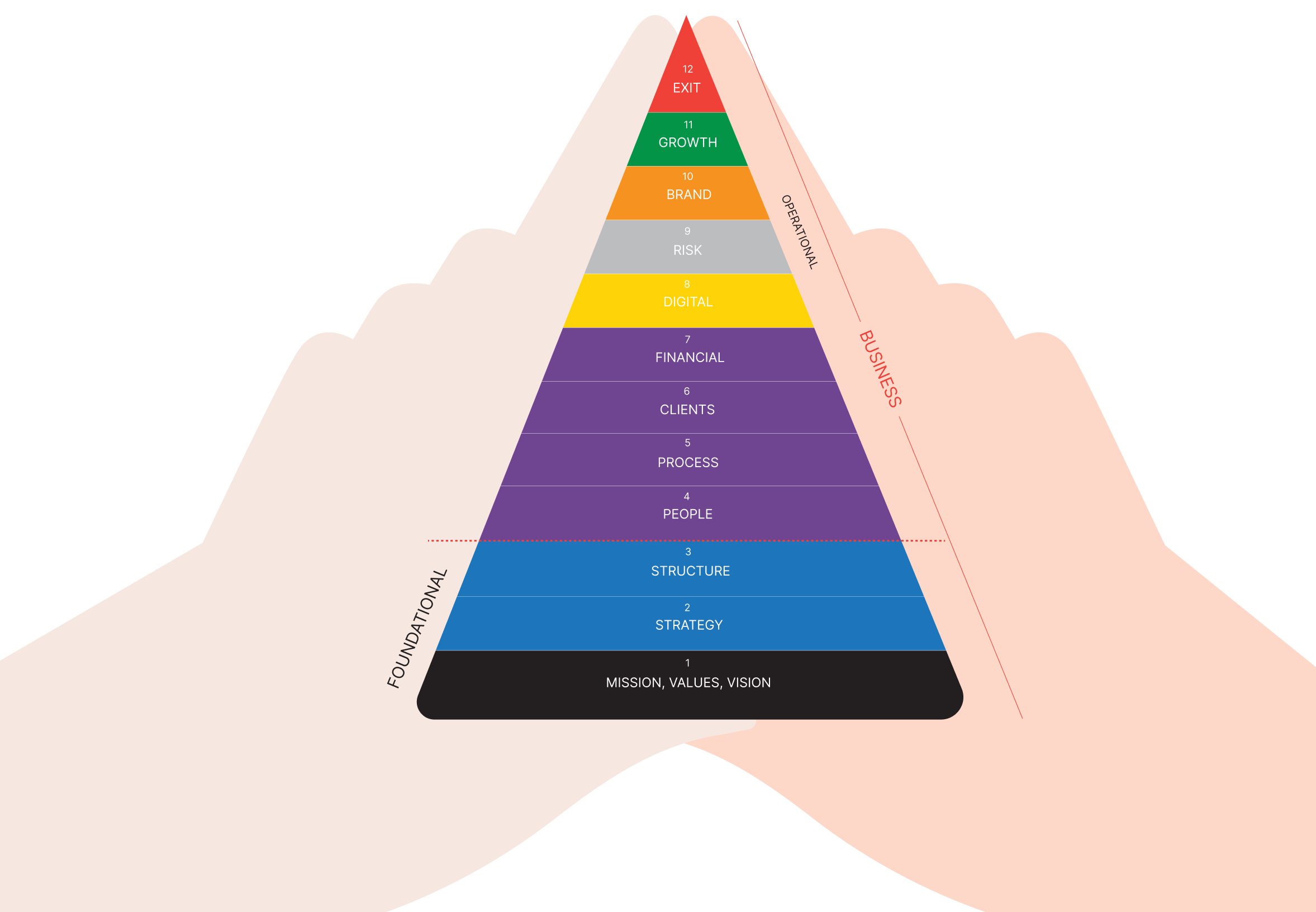

Transform your business with practical tools designed to accelerate personal and business growth.

Based on the Kelly+Partners Progress Pyramid, our growth tools cover twelve practical focus areas across Foundations and Operations. They’re designed to help you reflect, realign, and move forward with purpose.

We'll bring structure to your thinking, clarity to your strategy, and momentum to your execution—driving progress in your life, leadership, and business.

Kelly+Partners Financial Progress System™

At Kelly+Partners, our philosophy is simple: expert advice tailored to your personal, business, wealth, and estate needs. With structured systems and year-round contact, we deliver clear, strategic guidance for long-term financial progress.

1. Place

We start by identifying where you are today—then work with you to define clear goals for the next 5, 10, and 20 years.

2. Profile

We map your personal and business finances, wealth position, and succession needs to build a complete picture.

3. Plan

A tailored financial strategy is created to align with your objectives—ensuring structured, consistent progress.

4. Progress

We track your performance through regular reporting—monthly or quarterly—so you stay on course and in control.

News & Insights

Learn more ➜

Podcast

Learn more ➜

Client Experiences

Learn more ➜

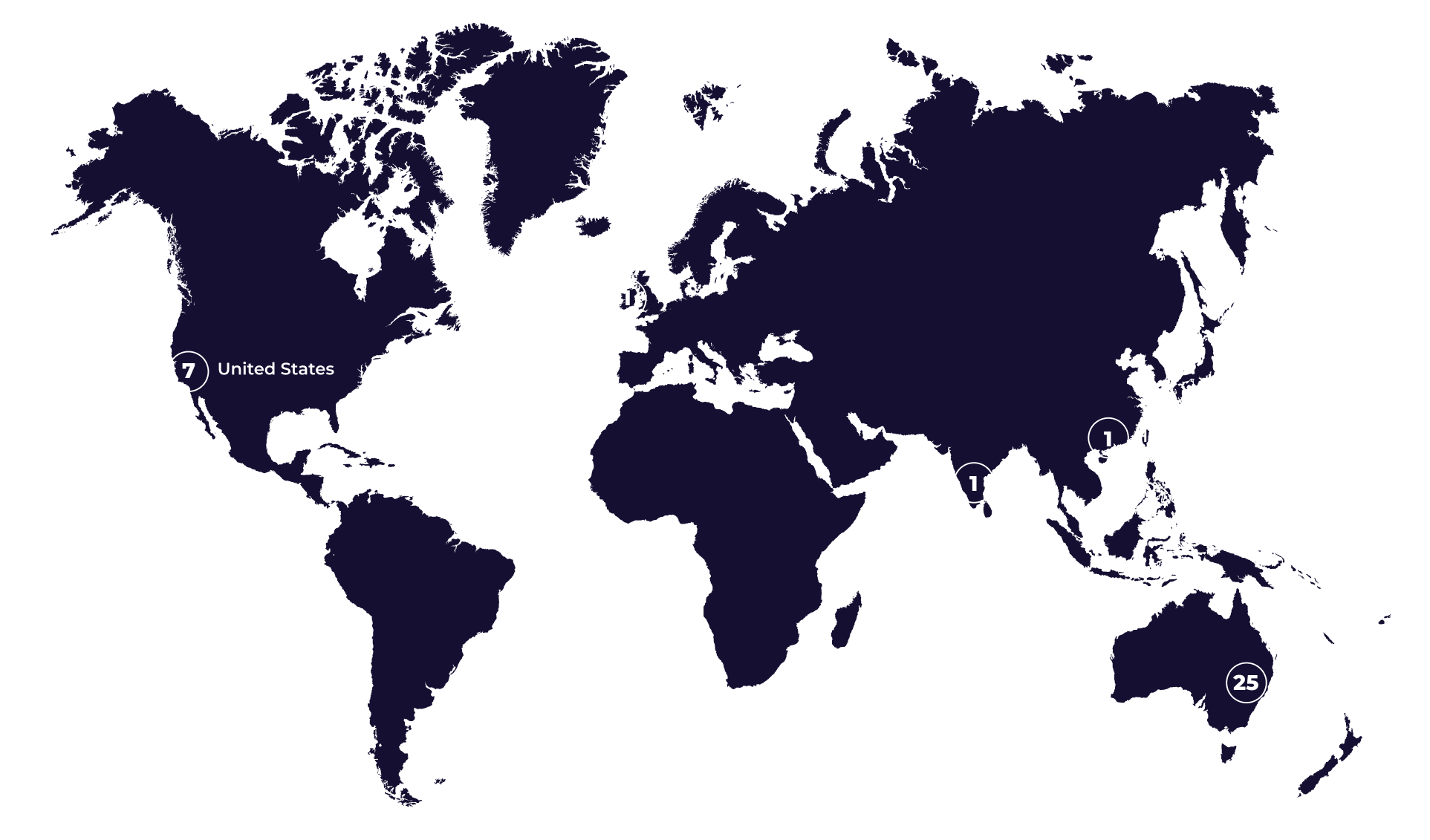

Partnering with Private Business Owners Globally

Kelly+Partners is fully cloud-based, making it easy to work with you wherever you are. If you prefer meeting in person, our offices are located across Australia, the United States, Ireland, Hong Kong, and India.

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)