What does JobKeeper 2.0 mean for you and your business?

|

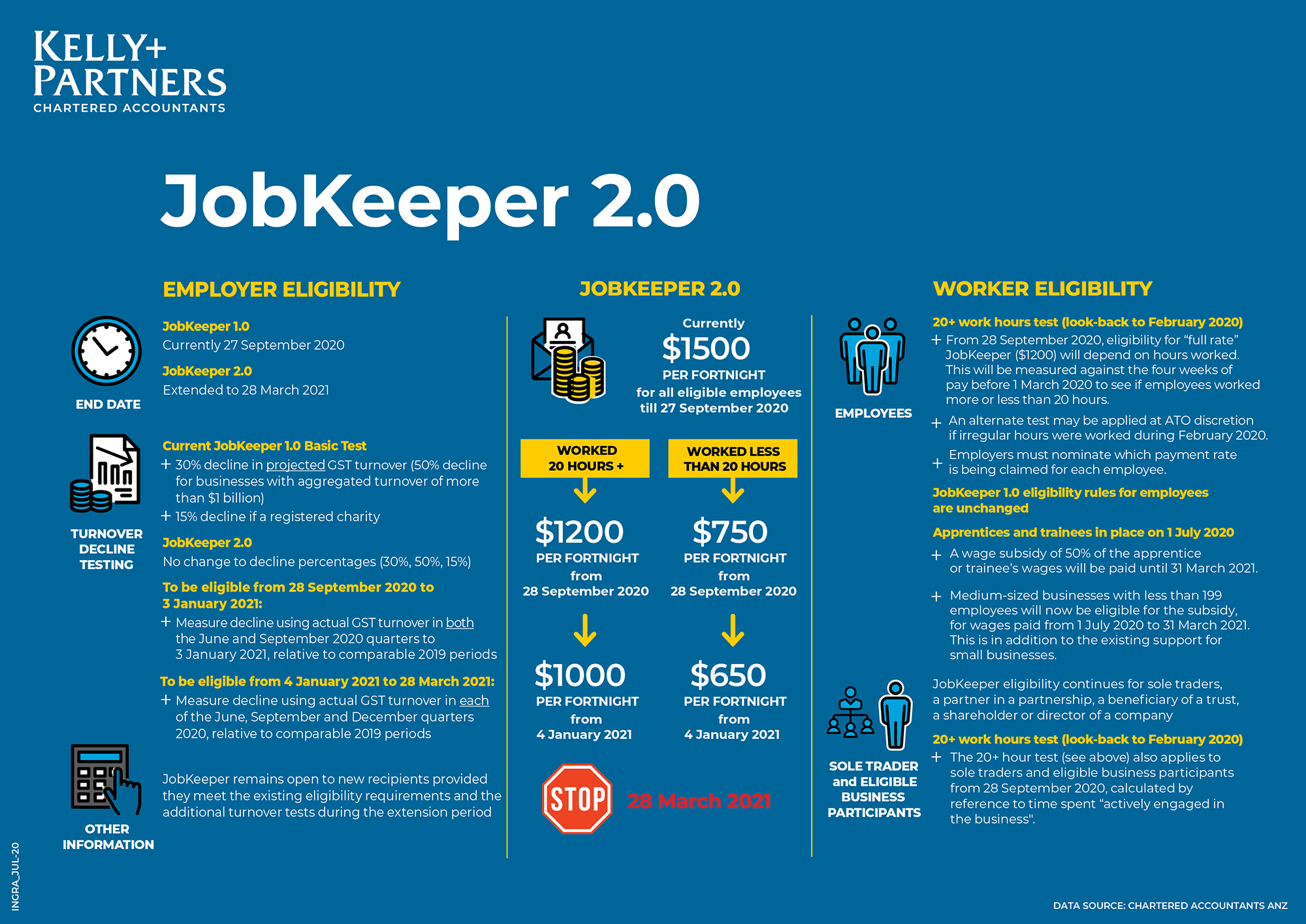

Need help wrapping your head around the new JobKeeper payment updates? Or perhaps you’re wondering how the overhaul will impact you, your employees and your business? The Federal Government has announced that that the JobKeeper payment, which was originally due to run until 27 September 2020, will now continue to be available for eligible businesses until 28 March 2021. From the first week of October, the payment will be reduced, and a new, two-tiered system will be introduced to separate part-time and full-time payments. The overhaul will also feature tighter eligibility requirements for businesses to receive the subsidy. What are the new JobKeeper 2.0 changes?Below is a summary of all the key JobKeeper 2.0 details. Click the image or click here to download as a pdf.

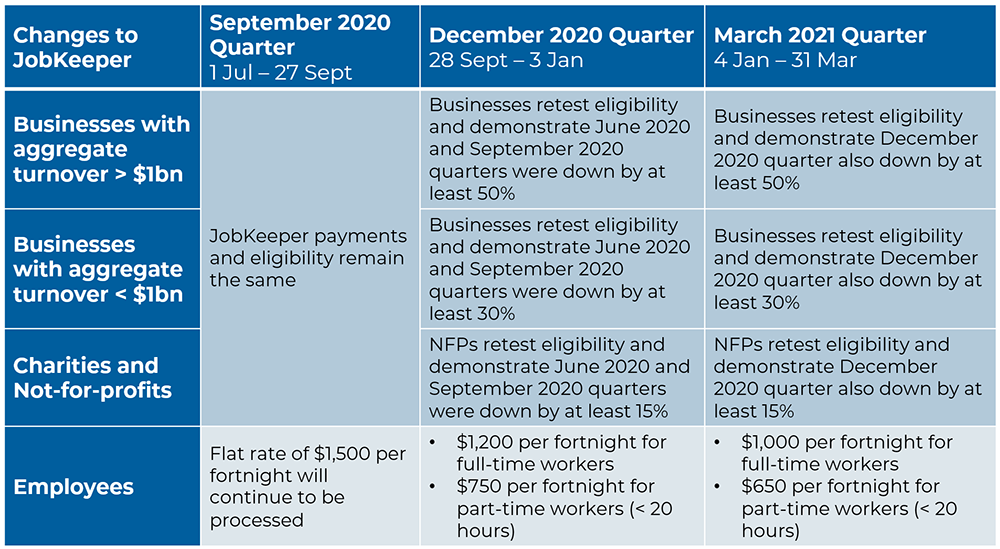

The following table provides an overview of the changes to JobKeeper for each remaining quarter of the program:

What do these changes mean for your business?Employers and businesses will need to retest their GST turnover prior to lodgement of their September and December quarter Business Activity Statements (BAS). The turnover test will look at actual turnover decline as opposed to projected GST decline. From 28 September 2020 onwards, all businesses will need to re-qualify and demonstrate relative decline in the previous quarter in comparison to the relative 2019 quarter. For more information on this, click here. If you have any concerns or questions about how these COVID-19 changes will impact your business day to day, contact your small business accountant today. |

Why is it changing from a flat-rate scheme?The Government emphasised the need for a dynamic response to the virus with the initial JobKeeper scheme being established at the height of COVID-19’s outbreak. JobKeeper 2.0 is designed to better reflect pre-COVID incomes. This comes in light of announcements that 25% of employees received an increase in income under JobKeeper. The tiered system is also designed to incentivise employees to work more hours. What has JobKeeper achieved so far?

If you have any questions, please contact your local Kelly+Partners office today. You can also request a call back at a time that suits you.

We are here to help. |

Share this

You May Also Like

These Related Stories

.png)

$15 billion JobKeeper extension announced amid COVID-19 developments

.png)

The Latest JobKeeper 2.0 Changes - Is your Business Still Eligible?

.png)

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)