The small business entity (SBE) aggregated turnover test is used to determine a business’ eligibility for a range of tax concessions. The test requires the annual turnovers of the business and its affiliates and any entities connected with it (if any) to be aggregated.

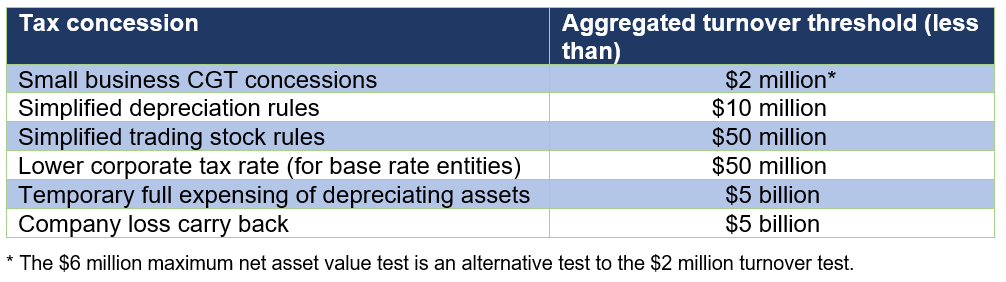

However, the applicable turnover threshold varies depending on the particular tax concession. For example:

The ATO recently issued one Taxation Determination, three Draft Taxation Determinations and an Addendum to a Law Companion Ruling discussing aspects of the SBE aggregated turnover test.

According to the ATO, the relevant income year for calculating aggregated turnover is the income year of the business claiming the tax concession (ie the taxpayer) – thus only the annual turnovers of entities that are affiliates or entities connected with the taxpayer for the period that matches the taxpayer’s income year are included.

Example:

If the taxpayer has a 30 June year end while an entity connected with the taxpayer has a 31 December year end, the annual turnover of the entity connected with the taxpayer will have to be calculated as if it were a June balancer.

As regards to qualifying for the 25% corporate tax rate, the relevant year for calculating a company’s aggregated turnover is the income year in which its status as a base rate entity is being determined. The entity’s aggregated turnover for any earlier income year is irrelevant for this purpose. However, for franking purposes, the aggregated turnover for the income year immediately prior to the year in which the tax rate is being determined is instead used to determine the company’s franking rate.

These Related Stories