Do you know much you’ll need to comfortably retire?

“Don’t let making a living prevent you from making a life” - John Wooden

What would you say your ultimate goal is? To make money? Or to make time? As we know, time is the most valuable commodity in the world and one of the only things you can’t buy, trade or sell.

All the work that goes into taking control of your financial universe, such as removing debt, and planning your future, is to help give you the time and freedom to focus on things that bring meaning to your life. After a long career of hard work, the last thing you want is to get to retirement age and realise a simple retirement isn’t on the cards for you.

We’ve carefully designed this checklist to help you navigate your planning towards retirement regardless of where you are in life or what your current age is. After all, it’s never too early to start planning and preparing for the future.

Who's on your financial team?

The first step of planning your retirement, is to ensure everyone on your financial team is on the same page. If you haven’t already discussed this with your accountant, now is a great time to start preparing for every stage of your life and your family’s life so you can look towards the future with confidence. This is particularly important when you reach your 40’s and start to think about your retirement planning.

What will retirement look like for you?

Knowing exactly how much money you need to put away to make work a choice rather than a necessity is extremely powerful, but many people don’t realise this until it’s too late.

The Global Retirement Reality Report (2018) found that 45% of Australians feel financially insecure about their retirement. 38% of Australia’s working population believe their expected savings will be ‘not at all close’ to what they need when they retire.

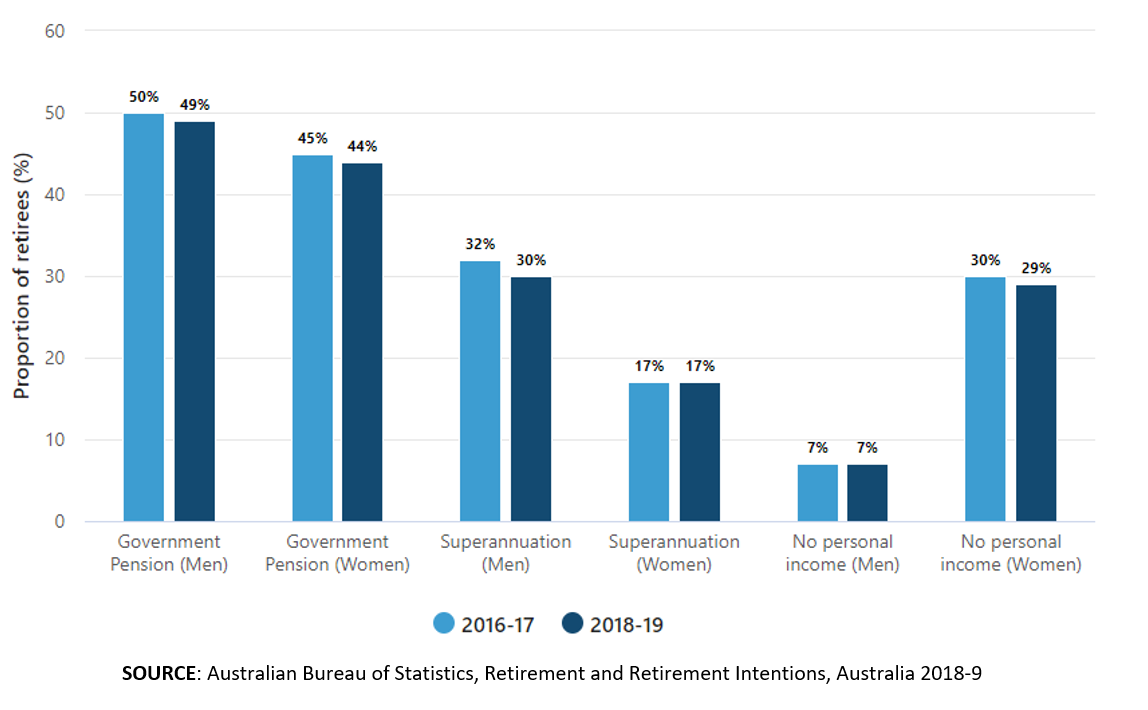

This is backed up by the fact that the retirement savings gap (the shortfall between your retirement income and the income needed for your life expectancy) per Australian in 2014 was estimated to be around $70,100 after the Age Pension. With 50% of the population relying on the government pension as their main source of income (see the graph below), it’s no wonder people feel clouded by doubt and uncertainty about their retirement.

What are Australian's main source of income?

Of course, financial comfort is relative and not defined by a single asset value. But feeling financially comfortable in retirement and having the security, comfort and confidence to know your income is taken care of is invaluable.

What's your Retirement One Number?

So, how much do you need to comfortably retire?

The most common rule of thumb in retirement planning is two-thirds (67%) of your pre-retirement income to maintain the same standard of living in retirement.

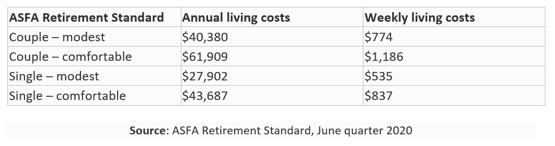

This is the Association of Superannuation Funds of Australia’s (ASFA) estimate of how much money you’ll need in retirement, depending on your lifestyle:

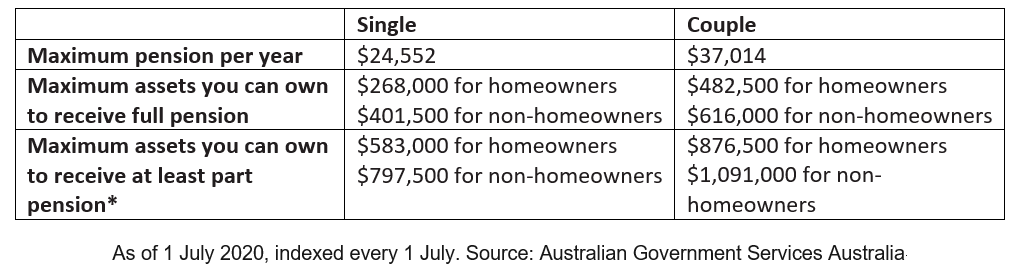

The table below lays out the maximum age pension you can receive per year if you own less than the maximum assets you can have to be eligible.

In 2020, the average life expectancy is 83.50 years and Pension age is 66 years, giving an approximate retirement period of 17.5 years.

To live at a comfortable standard as a couple, receiving the maximum age pension of $37,014 per year, you would only need to make up the remaining $24,895 per year. 17.5 years x $24,895 per year = $435,662.50.

$435,663 in super for couples, and $334,863 for singles should be your goal retirement number.

Retirement planning is about making sure your money goes the distance. Having a great accountant in your corner means you can start planning ahead decades in advance so you can reap the benefits of financial freedom now and into the future.

Still find the thought of retirement planning daunting? Start with this simple checklist for yourself and your accountant and go from there:

Checklist Questions to nail your retirement planning:

ASK YOURSELF:

- What age do I want to retire?

- How much money will I need for retirement and where will I get it?

- What recreational activities are on my to-do list?

- How and when will I access my super?

- Will I be entering retirement debt-free?

- Do I have other matters such as insurance, investment and estate planning that need addressing?

- Will I relocate or downsize?

- Do I want to make any final super contributions?

- What brings meaning to my life? When I retire what do I want to focus my energy on ?

ASK YOUR ACCOUNTANT:

- How much money do I need to have saved to retire at my desired age?

- Can you help me manage my savings, debt, estate plan and dependants in retirement?

- Will I be eligible for government entitlements?

- Can you help me review my insurance?

- What are my salary sacrifice options?

- Can you help me find advisers to assist with my investments and estate planning?

DISCLAIMER

Kelly Partners Private Wealth (Wholesale) Pty Ltd is a corporate authorised representative of Kelly Partners Private Wealth Pty ltd (AFSL: 516704, ABN 14 629 559 860). Any general advice provided has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider the appropriateness of the advice with regard to your objectives, financial situation and needs.

Kelly Partners Private Wealth Sydney Pty Ltd is a corporate authorised representative of Madison Financial Group Pty Ltd (AFSL: 246679, ABN: 36 002 459 001)

Share this

You May Also Like

These Related Stories

Retirement Planning: 4 Ways Your Small Business Accountant Can Help You Plan Your Retirement

Retirement Planning - Top 5 things to think about for your retirement

.png)

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)