Client Newsletter

In this edition, discover the power of franking credits and working capital for business growth. Plus, gain inspiration from our business owner spotlight and enrich your reading list with our monthly book recommendation 'The Outsiders' by William Thorndike.

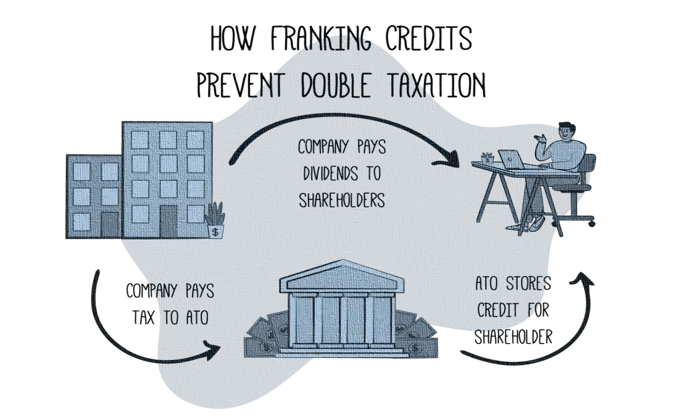

What are Franking Credits?

When Australian companies pay dividends, they can pass on the tax they've already paid on their profits to shareholders in the form of franking credits. This means the dividends come with a credit for the corporate tax rate, which is currently 25% (base rate entity) or 30% (non-base rate entity). Essentially, the tax the company has already paid can be credited to the shareholders, reducing their income tax liability on these dividends.

How Franking Credits Work

- Company Pays Tax on Profits

First, a company pays the corporate tax rate on its profits. - Dividend Declaration:

When distributing dividends, the company can attach a franking credit that represents the tax amount already paid on those profits. - Shareholder Tax Obligation:

When shareholders receive dividends, they must include both the dividend and the franking credit in their taxable income. - Credit Against Income Tax:

Shareholders can use franking credits to offset their income tax liability. If the franking credits exceed the tax due on the dividends, they can also be applied against other taxable income or, for some individuals, be refunded.

Benefits of Franking Credits

- Avoid Double Taxation:

Franking credits prevent the profits of a company from being taxed at both the corporate and shareholder levels. - Tax Effective Income:

For investors, particularly those in lower tax brackets, franking credits can significantly reduce or even eliminate the tax payable on dividends. - Potential Tax Refunds:

If the total franking credits are greater than the total tax liability, shareholders may receive a tax refund.

Example:

Suppose an Australian company pays you a dividend of $700, and the dividend comes with a franking credit of $300 (representing the tax the company has already paid at 30%). Your total taxable income from this dividend would be $1,000 ($700 + $300). If you're taxed at a rate of 21%, your tax on the dividend would be $210. The $300 franking credit covers this $210 tax, and the $90 excess can reduce your other tax liabilities or be refunded.

Franking credits are particularly valuable in dividend investment strategies, and understanding how to utilise them can enhance the after-tax return of your investments. Always consult with a professional advisor to maximise these benefits according to your specific financial situation.

Question: “What is working capital and how much do I need?"

Answer: Working capital is the money a company uses for its day-to-day operations. It’s calculated as the difference between current assets and current liabilities.

- Current Assets: Items that can be converted into cash within a year (e.g., cash, accounts receivable, inventory).

- Current Liabilities: Obligations due within a year (e.g., accounts payable, short-term debt).

Importance of Working Capital

- Liquidity: Ensures the company can pay its bills on time.

- Operational Efficiency: Shows how well the company manages its resources.

- Financial Health: Positive working capital indicates good financial stability; negative working capital may signal potential financial trouble.

How Much Working Capital Do You Need?

The amount of working capital needed varies based on several factors:

- Industry Norms: Different industries have different requirements. Retail businesses need more for inventory, while service businesses may need less.

- Business Size: Larger businesses typically need more working capital.

- Operational Cycle: The length of the cash conversion cycle impacts needs. A longer cycle requires more working capital.

- Seasonality: Seasonal businesses may need more working capital during peak seasons.

- Credit Terms: Longer credit terms to customers increase working capital needs.

General Guidelines

- Current Ratio: A ratio (current assets divided by current liabilities) between 1.2 and 2 is generally healthy.

- Industry Benchmarks: Comparing your needs to industry standards can provide a rough estimate. Manufacturing might need 20-30% of annual sales, while services might need less.

- Buffer for Emergencies: Maintain an additional buffer to cover unexpected expenses.

Practical Steps

- Monitor Regularly: Review working capital needs and adjust for changes in sales, inventory, and receivables/payables.

- Optimise Cash Flow: Manage receivables and payables efficiently to improve cash flow.

- Plan for Growth: Reassess working capital needs as your business grows to support expansion.

#1 on Warren Buffett’s Recommended Reading List, Berkshire Hathaway Annual Shareholder Letter, 2012

The Outsiders is a captivating book by William Thorndike that explores the common traits of successful CEOs. Through fascinating case studies, the book provides valuable lessons on decision-making and leadership that can be applied to any industry.

In today's rapidly evolving business landscape, staying ahead requires not just hard work but strategic foresight and efficient management. Our mission is to empower you with the tools and insights needed to navigate the complexities of modern business. Here’s how we can support your journey toward sustainable growth and efficiency across four critical areas:

1. Cash Flow Management

Cash flow is the lifeblood of your business. Effective management means ensuring that your business maintains the liquidity needed to cover daily operations while planning for future growth. We assist in identifying the key drivers of cash flow within your business, implementing strategies to optimise collections, manage payables, and ensure efficient use of working capital. Through targeted analysis and customised advice, we can help you enhance your cash position, providing the stability and flexibility your business needs to thrive.

2. Budgeting and Forecasting

A well-structured budget and accurate financial forecasts are your roadmap to financial success. They enable you to set realistic targets, measure performance, and adjust strategies proactively. Our approach involves working closely with you to understand your business's unique dynamics, helping to craft detailed budgets and forward-looking forecasts. This process not only provides clarity and direction but also prepares your business to adapt swiftly to market changes, seize opportunities, and mitigate risks.

3. Virtual CFO Services

For many small to medium-sized enterprises (SMEs), having a full-time Chief Financial Officer (CFO) is not feasible. Our virtual CFO services offer a strategic solution, providing you with high-level financial expertise without the full-time commitment. From strategic planning, financial analysis, to investor relations, we bring the insights and leadership of an experienced CFO to your team. This partnership allows you to make informed strategic decisions, secure funding, and drive profitability, all while keeping overhead costs manageable.

4. Software System Stack Integration

In the digital age, the right technology stack is fundamental to operational efficiency and competitive advantage. We evaluate your current systems and processes, recommending and implementing software solutions that align with your business goals. From accounting software to CRM systems and beyond, we ensure seamless integration and optimisation of your tech stack, freeing your team from manual tasks and enabling data-driven decision-making.

Find your nearest office

Email our team, give us a call, or visit one of our convenient office locations.

/Images/Federal%20Budget/Locations_desktop.webp?width=2252&height=1410&name=Locations_desktop.webp)

Take control of your financial universe

Achieve your personal and business goals by turning to Kelly+Partners Accountants today.

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)