Did you know that if you hired a new employee aged 35 or younger between 7 October 2020 and 6 October 2021, you may be able to claim the JobMaker Hiring Credit?

To receive JobMaker Hiring Credit payments, you must:

- hold an active Australian business number (ABN);

- be registered for pay as you go (PAYG) withholding;

- be up to date with lodging your income tax and GST returns for the two years up to the end of the JobMaker period for which you are claiming.

You may be able to get payments of:

- up to $200 a week – for each eligible employee aged 16 to 29 years old;

- up to $100 a week – for each eligible employee aged 30 to 35 years old.

Note: JobMaker Hiring Credit payments are made every three months in arrears.

When to claim JobMaker

You make a claim for each JobMaker period you are eligible.

You can do this through ATO online services, the Business Portal or your registered tax or BAS agent.

Claims open on the first day of the month after the JobMaker period ends. They remain open for three months.

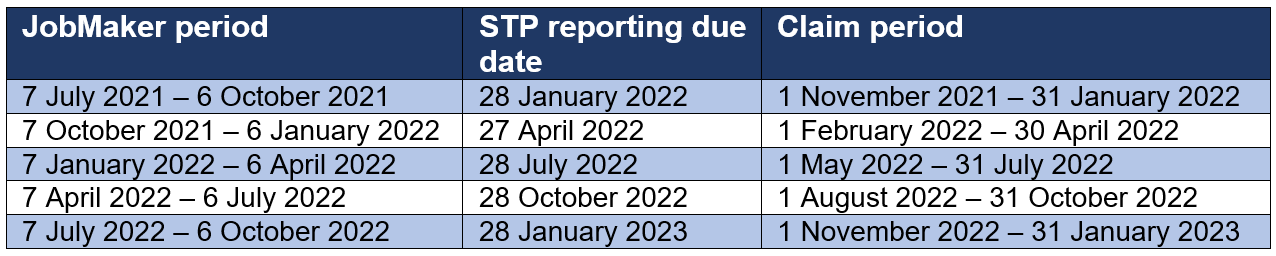

The table below shows various key dates.

Please talk to your Kelly+Partners Client Director if you have any questions about the JobMaker hiring credit scheme and how to claim it.