Private Wealth, Finance & Insurance

Our dedicated team of specialists across investments, finance and insurance can help you achieve your business and personal goals.

/Images/Industries/Automotive-Repairers-Mobile.webp?width=1120&height=1088&name=Automotive-Repairers-Mobile.webp)

Wealth Management

Take control of your financial universe and build the confidence to make the decisions that matter for you and your family with the help of Kelly+Partners Private Wealth.

Private Wealth Management

Kelly+Partners Private Wealth delivers bespoke investment solutions and portfolio management for Wholesale and Sophisticated investors.

Kelly+Partners Direct Invest

Kelly+Partners Direct Invest offers a low-cost, professionally managed, and fully diversified portfolio—making investing simple and accessible.

.jpeg?width=800&height=384&name=image%20(1).jpeg)

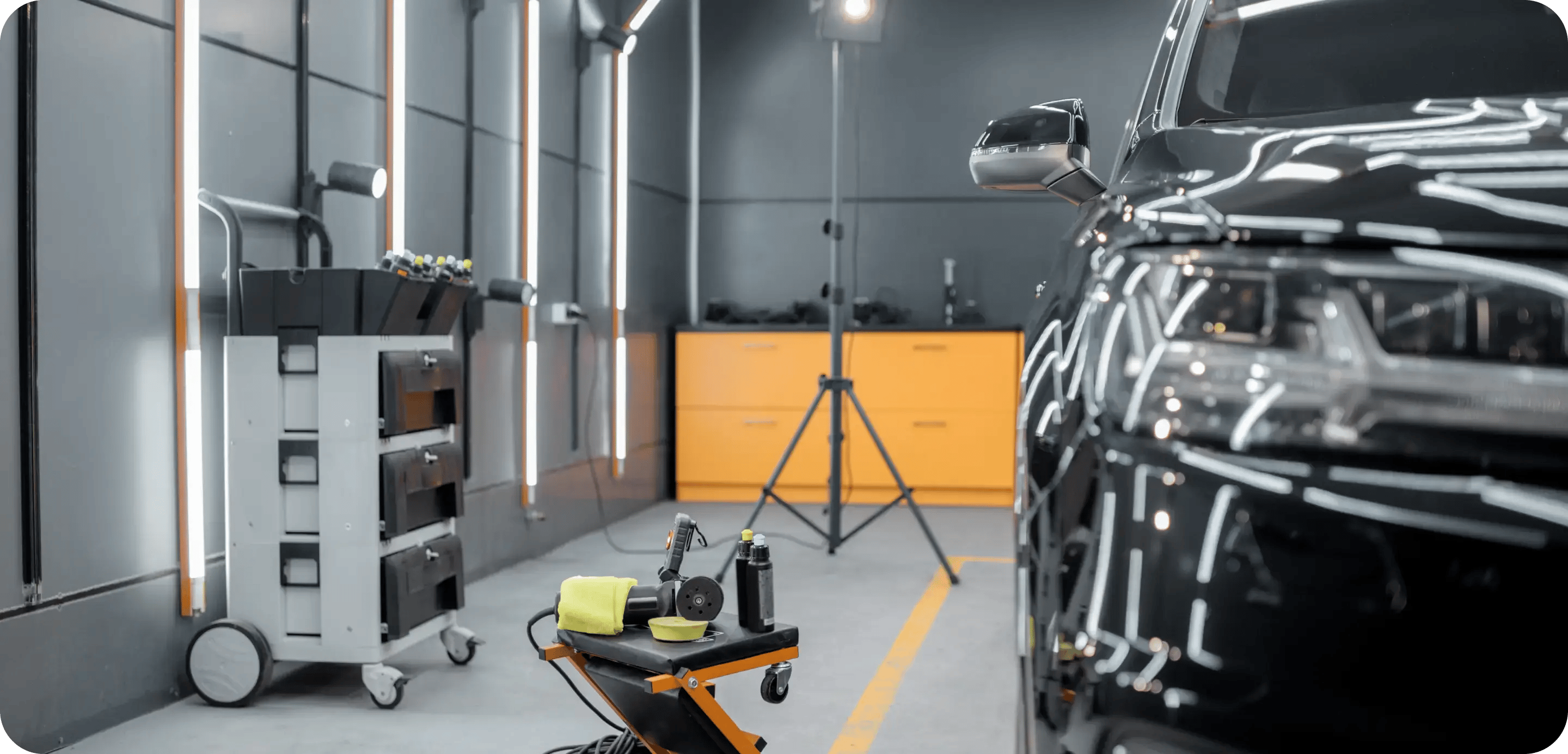

Insurance Solutions

Kelly+Partners Insurance Solutions provides tailored personal and business insurance solutions to protect your finances, family, and future to achieve financial peace of mind.

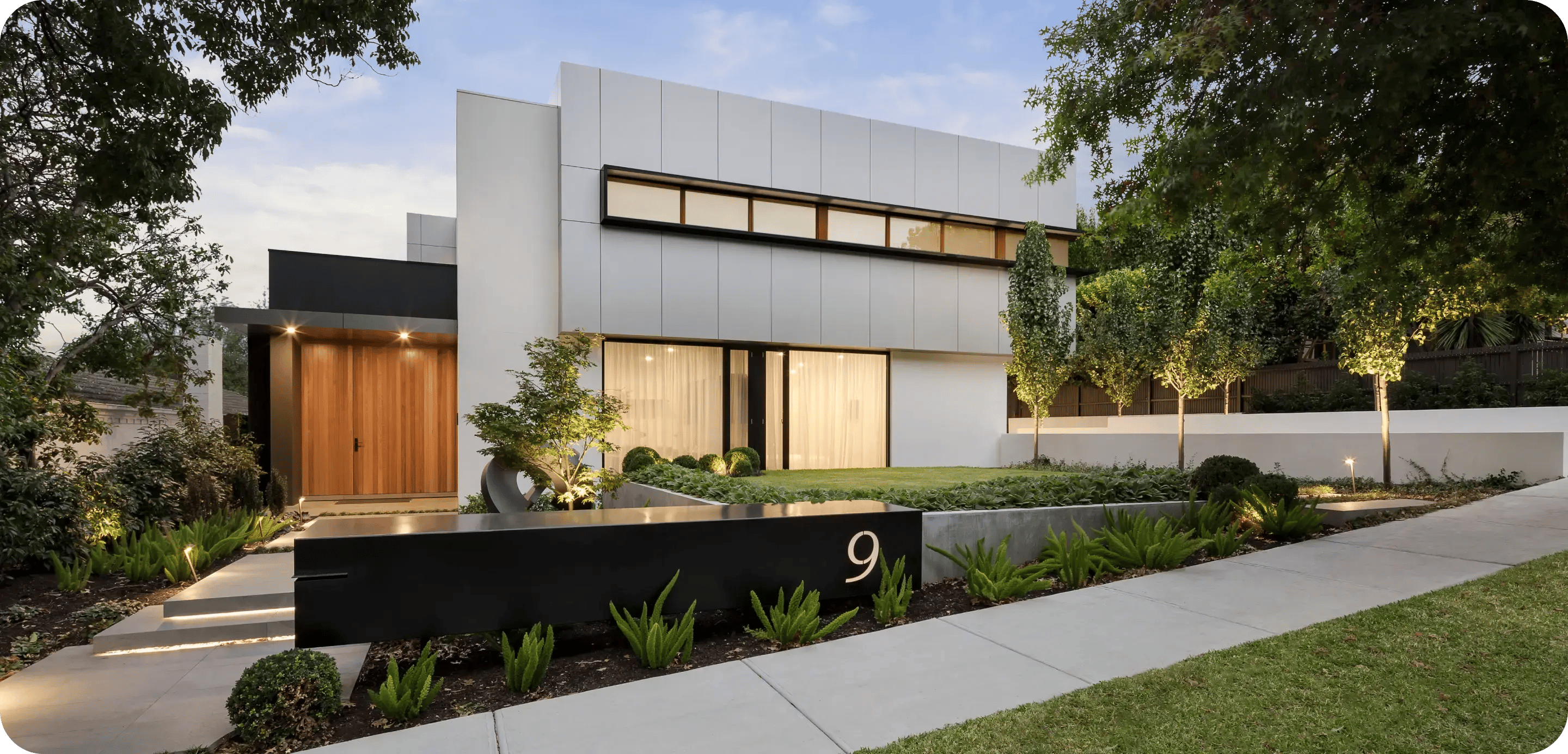

Finance & Mortgage Broking

Whether you’re a first home buyer, looking to upgrade your home, or looking to invest in your business, we're here to guide you through each stage of your unique journey.

Personal & Business Lending

Tailored lending solutions for homebuyers and business owners, offering expert guidance, transparency, and access to a wide range of lenders.

Home & Investment Loans

Find the right loan for your first home, next home, or debt consolidation with expert, one-on-one support. We tailor solutions to your needs, providing transparent, proactive guidance.

Commercial & Business Loans

Secure the right funding to build and grow your business with a tailored loan solution. We work with you and your accountant to understand your structure, cash flow, tax implications and goals.

Financial Progress System™

The Kelly+Partners philosophy is simple - expert advice that is tailored to the client's unique personal and business circumstances. Structured systems and year round contact ensure timely, sophisticated and forward-looking advice.

1. Place

The system begins by identifying where you are today and understanding your goals for the next five, ten, and twenty years.

2. Profile

Personal and business finances, wealth management, and succession planning are addressed to build a clear financial path.

3. Plan

A bespoke financial strategy is crafted to align with your business and personal objectives, ensuring consistent progress.

4. Progress

Financial metrics are reviewed regularly, with monthly or quarterly reports to keep you on track toward achieving your goals.

News & Insights

Learn more ➜

Podcast

Learn more ➜

Client Experiences

Learn more ➜

Take control of your financial universe and Be Better Off

Gain expert guidance from a private wealth or finance specialist to help you control, grow, and protect your financial universe.

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)