5 of Charlie Munger’s Most Important Pieces of Advice

Takeaways:

- Think Broadly: Munger’s “latticework of mental models” teaches that drawing knowledge from multiple disciplines leads to better decisions.

- Invert to Solve Problems: By asking what to avoid, you often discover the smartest path forward.

- Understand All Sides: True wisdom comes from studying opposing viewpoints before forming an opinion.

- Don’t Predict, Prepare: Munger and Buffett’s success came from investing in great businesses, not guessing the future.

- Read Constantly: Lifelong learning and wide reading are essential for building wisdom and perspective.

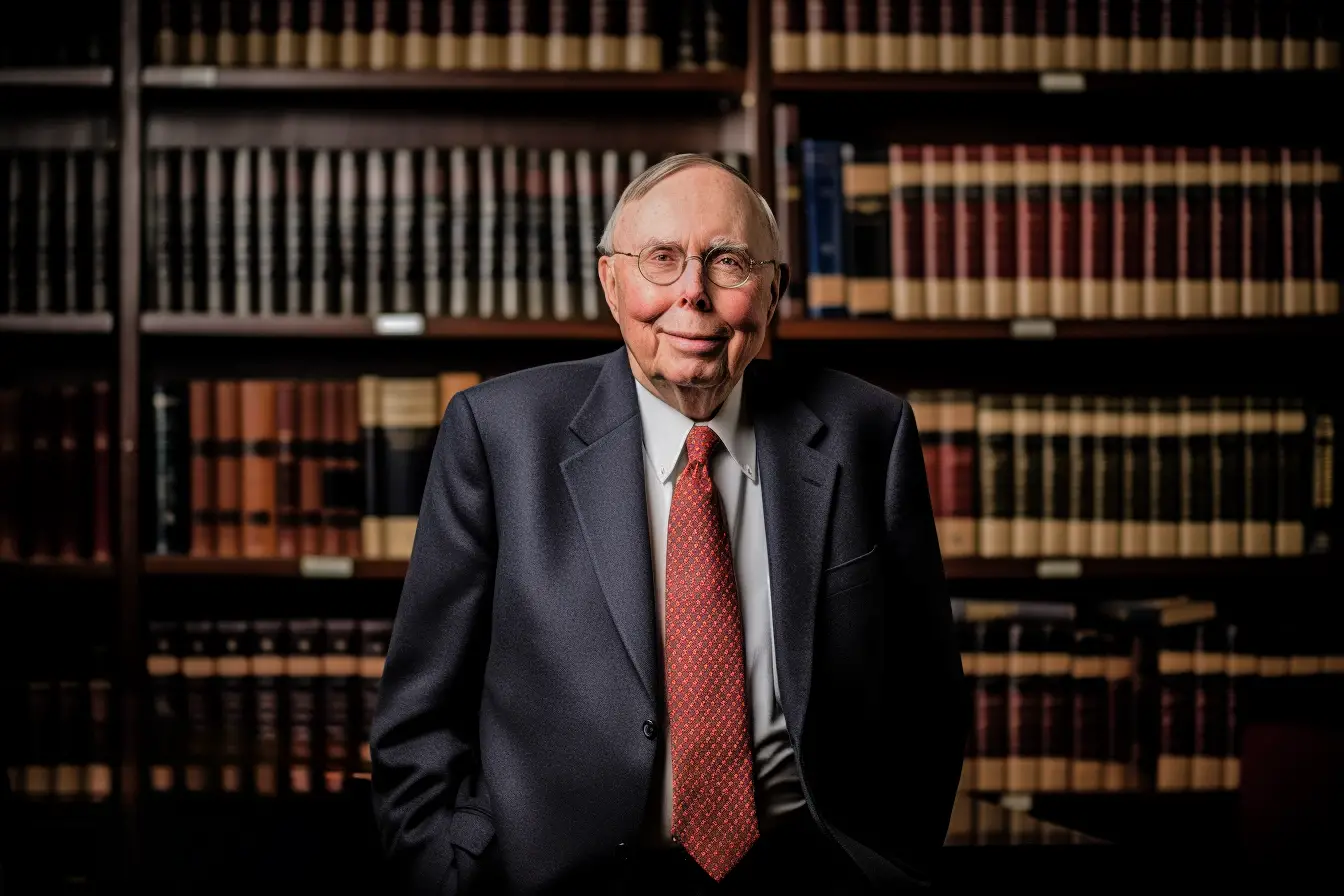

Charlie Munger — the legendary vice chairman of Berkshire Hathaway and long-time partner of Warren Buffett — left behind a legacy of wit, wisdom, and timeless lessons. Known for his sharp intellect and no-nonsense approach, Munger’s thinking shaped not only Berkshire Hathaway’s extraordinary success but also the mindset of countless investors and business leaders around the world.

As we reflect on his life and insights, here are five of Charlie Munger’s most powerful lessons — principles that go far beyond investing and offer enduring guidance for decision-making, learning, and living wisely.

Build a Latticework of Mental Models

Munger believed that to make sound decisions, we need a latticework of interconnected mental models — frameworks drawn from multiple disciplines such as economics, psychology, physics, and philosophy.

“You’ve got to have models in your head… and you’ve got to have multiple models,” he once said.

His philosophy was that great decision-makers don’t rely on isolated facts or a single way of thinking. They pull insights from different fields and connect them to see the world more clearly. Whether in investing, business, or life, a well-developed mental framework helps us interpret complexity and make better judgments.

The Power of Inversion

One of Munger’s favourite problem-solving methods was inversion. Instead of asking, “What should I do to succeed?” he’d ask, “What should I avoid to fail?”

Inspired by the 19th-century mathematician Carl Jacobi’s phrase “Invert, always invert,” Munger used this approach to simplify complex decisions. For example, if you want to live a healthy life, think about what behaviours would destroy your health — such as inactivity, overeating, or lack of sleep — and avoid them.

This backward thinking is equally powerful in investing: by identifying what leads to poor outcomes (like chasing trends or overtrading), we can clarify which behaviours lead to success.

Understand the Other Side

Munger warned against ideological bias and lazy thinking. His rule: You’re not entitled to an opinion unless you can state the opposing argument better than your opponent can.

This mindset, which he shared in a 2007 commencement address at USC’s School of Law, reminds us that wisdom comes from understanding, not echoing. Munger believed that strong opinions must be built on curiosity, discipline, and empathy — qualities often missing in today’s polarised world.

Don’t Try to Predict the Future

Despite Berkshire Hathaway’s phenomenal long-term success, Munger and Buffett never claimed to predict the market. Instead, they focused on investing in good businesses and holding them long enough for value to compound.

“I don’t make money predicting accurately,” Munger said. “We just tend to get into good businesses and stay there.”

He compared financial forecasts to ancient kings hiring soothsayers to read sheep entrails—a humorous but sharp reminder that the future is unknowable—his advice: ignore short-term predictions and focus on principles that stand the test of time.

Be a Lifelong Reader

If there was one habit Munger credited for his success, it was reading — constantly.

“In my whole life, I have known no wise people who didn’t read all the time — none, zero.”

He viewed reading as essential for developing wisdom and perspective. More importantly, he encouraged people to read widely — beyond their field — to build the broad knowledge base necessary for true understanding. “To the man with a hammer, the world looks like a nail,” Munger often said, warning against narrow expertise.

His final message was simple: be a lifelong learner, stay curious, and strive to be a little wiser each day.

Final Thoughts

Charlie Munger’s wisdom transcends investing. His lessons on thinking, humility, and lifelong learning remind us that success is not about predicting the future — it’s about cultivating the right mindset to navigate it.

As Munger himself might say, the goal isn’t to be brilliant all the time — it’s to avoid stupidity, think clearly, and keep improving.

Reference:

Jennings, J. (2023, November 29). Remembering Charlie Munger: 5 of His Most Important Pieces of Advice. Forbes. Read the full article here.

Share this

You May Also Like

These Related Stories

3 Investing and Life Lessons From the Late Great Charlie Munger

Could Your Life Story Use an Update? Here’s How to Do It

.png)

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)