The Power of Compounding: The 2% Avalanche

Takeaways:

- Small Return Differences Compound Significantly: A consistent 2% annual return premium can generate tens of thousands in additional portfolio value over a decade, highlighting the exponential power of compounding.

- Achieving Higher Returns Requires Strategic Risk: With falling cash rates, maintaining a 2% premium above the RBA benchmark demands a shift toward higher-yielding, risk-adjusted assets beyond cash and term deposits.

- Yield Chasing Can Be Risky Without Fundamentals: Pursuing higher returns without assessing market, interest rate, and credit risks can expose investors to avoidable losses - making disciplined asset selection essential.

Warren Buffet once said of the power of compounding:

"Life is like a snowball. The important thing is finding wet snow and a really long hill".

This is a nod to the combination of both time and compound interest in increasing wealth.

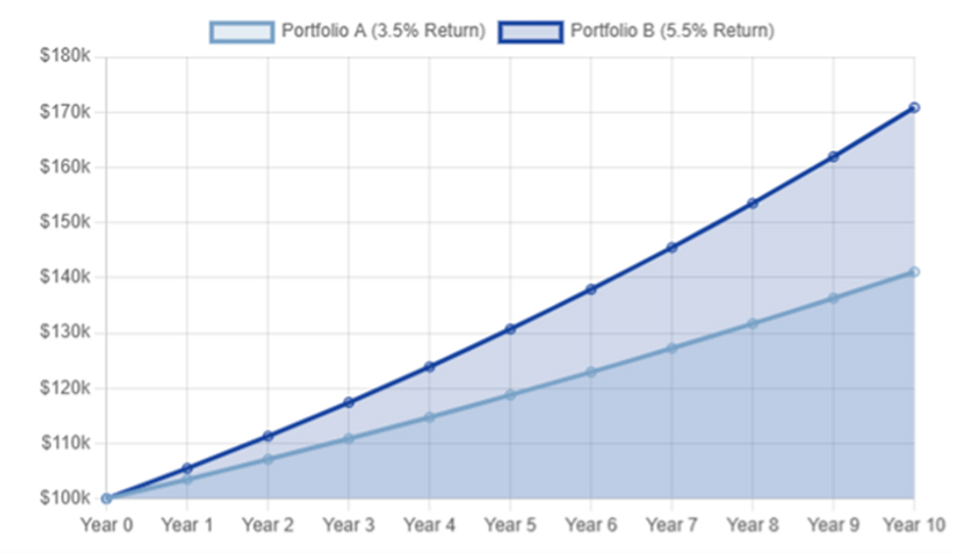

An investment strategy that achieves a sustained 2%+ annual return premium can create a significant difference in long-term wealth accumulation. For example, the comparison of a $100,000 portfolio reveals that a 5.5% annual return, compared to a 3.5% annual return, generates an additional $29,754 over a 10-year investment horizon. This substantial difference is not a simple linear gain but rather due to the exponential power of compounding.

The pursuit of this return premium, however, requires a deliberate shift in investment strategy. With the Reserve Bank of Australia's (RBA) cash rate at 3.6% (and market expectations pointing towards further reductions), a target return of 5.6% or higher may require investors to consider a different approach to their asset allocation and risk profile.

Even a seemingly small 2% difference in annual returns can create a substantial gap in portfolio value over a decade. Let's look at how an initial $100,000 investment grows in two different scenarios:

After 10 years, the higher-performing portfolio not only grew more, but the difference in total earnings becomes a significant amount, highlighting the long-term cost of lower returns.

- Portfolio A (3.5% p.a.)

$141,060 - Portfolio B (5.5% p.a.)

$170,814 - The 2% Difference

$29,754

The RBA Cash Rate and the Risk-Return Trade-Off

The investor's goal of achieving a 2% premium above the current cash rate implies a target annual return of 5.6%. However, this is not a static benchmark. Financial markets, as reflected in the ASX 30 Day Interbank Cash Rate Futures, anticipate further rate cuts. Major banks also forecast a decline, with some predicting the cash rate could fall to 3.10% or even 2.85% by early to mid-2026. The RBA's own forecasts for private demand are conditioned on a cumulative 80 basis point easing in the cash rate over the coming year, which would support economic growth.

This dynamic environment presents a critical challenge for the investor. As the RBA's cash rate falls, the "risk-free" rate of return and the return on assets like cash and term deposits will also likely diminish. Consequently, an investor seeking to maintain that 2% premium would need to take on a higher level of risk to compensate for the diminishing returns from low-risk assets. This situation reframes the entire problem, transforming it from a static calculation into a dynamic investment strategy that must continually adapt to the changing economic climate.

The Hazards of Yield Chasing

The pursuit of a higher yield, such as the 5.6%+ target, can lead investors to focus on a single metric while ignoring crucial underlying fundamentals. This is a behavioural trap known as "yield chasing," and it can result in exposure to significant and often-overlooked risks.

Additionally, investors seeking a premium return must be aware of several other, more systemic, forms of risk.

Market Risk

Interest Rate Risk

Credit Risk

For an investor seeking a higher yield from fixed-income instruments, there is a temptation to move down the credit quality spectrum to issuers with a higher risk of defaulting on their payments. While these issuers offer a higher yield to compensate for this risk, they expose the investor to the possibility that the issuer will be unable to pay interest or repay the principal at maturity.

To achieve a return of 5.6% (2% above the RBA cash rate of 3.6%), investors typically need to move beyond cash and term deposits, embracing assets that carry higher potential returns but also greater risk. The key is to find a balance that aligns with your personal goals and risk tolerance.

As CEO and the fund’s portfolio manager at iPartners, Travis Miller, notes: “There is strong demand for a fund covering cash, term deposits and private credit assets amid the increasingly volatile markets around the world.

Managing Partner at Kelly+Partners Private Wealth, Trent Doughty, said “We are offering a monthly distribution and redemption feature in some of our fund offerings so our investors can be nimble, while securing their funds in a relatively safe harbour for six months or longer.” For wholesale investors (individuals with a gross annual income of greater than $250,000 for the past two years or net assets in excess of $2.5 million), the Core Income Income Fund has been designed to deliver a higher yielding portfolio of private credit and fixed income assets.

The iPartners Core Income Fund, targets an interest rate of 7% per annum, maintaining a holding in a selection of credit assets, fixed income and managed funds. The fund is designed to provide monthly applications, distributions and redemption feature, with a view to provide a stable income yield.

To learn more, please contact Kelly+Partners Private Wealth at: investments@kellypartners.com.au

Source: iPartners

Share this

You May Also Like

These Related Stories

Japan's Economic Revival: A Bright Spot for Global Investors

Private Credit in Australia vs. USA: A Tale of Two Markets

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)